On Sept. 19, Florida TaxWatch released Florida Economic Forecast: 2023-2028 / Q2 2024...

Join our family of readers for as little as $5 per month and support local, unbiased journalism.

Already have an account? Log in to continue. Otherwise, follow the link below to join.

Please log in to continue |

TALLAHASSEE — On Sept. 19, Florida TaxWatch released Florida Economic Forecast: 2023-2028 / Q2 2024, the second economic commentary in their new quarterly series. The data upon which these forecasts are based is provided through a partnership with the Regional Economic Consulting Group (REC Group), a research-based consulting firm that provides economic studies to help guide and inform business leaders and policymakers.

Florida TaxWatch President and CEO Dominic M. Calabro said, “Florida’s economy grew by more than $140 billion during 2023, reaching a gross domestic product of $1.58 trillion, making it the 16th largest economy in the world, however, its sustainability is a question that must be asked and answered. As Florida TaxWatch pours through this data each quarter, we have found several contributing factors to the conversation, including population and net migration, employment, GDP and income growth, and tourism, that must be addressed over the next five years.”

The key takeaways from the report include the following outliers.

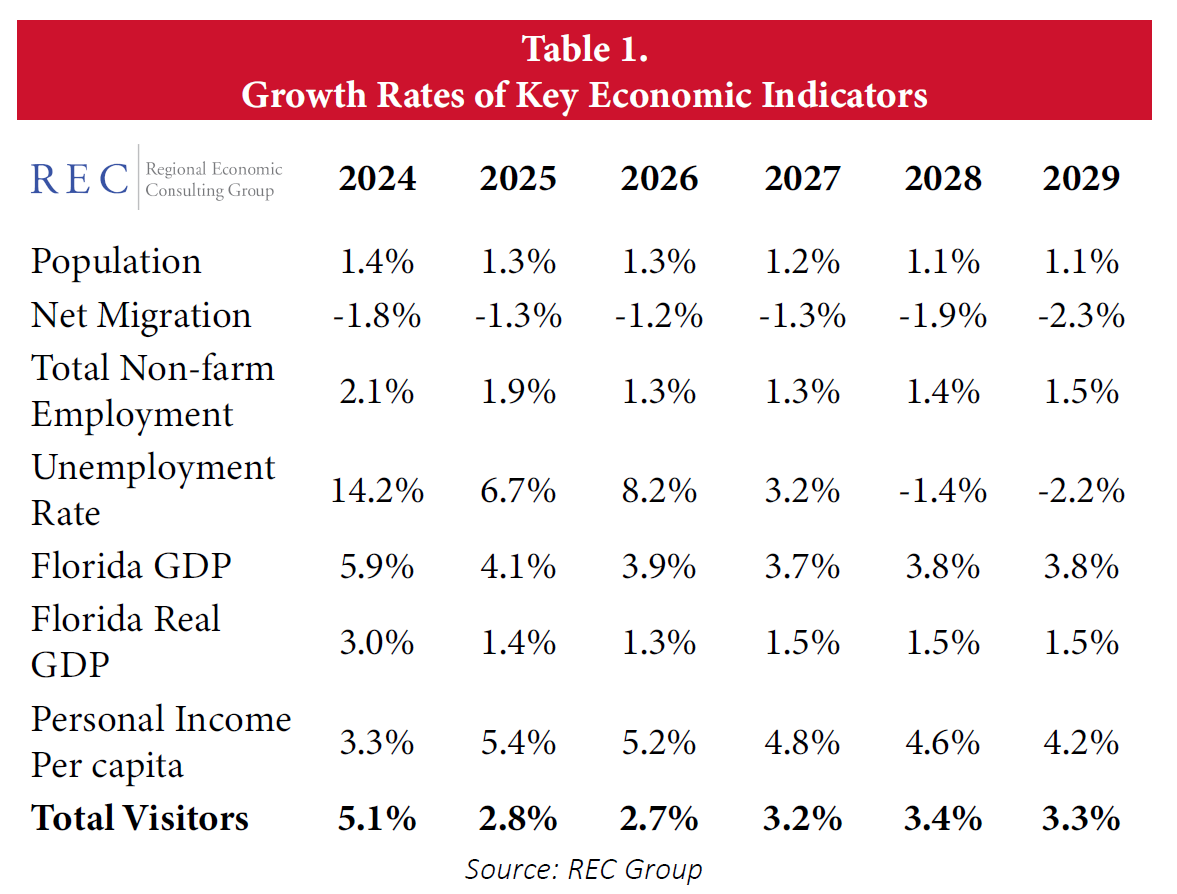

Population and Net Migration: Florida’s population will continue to increase, but at a decreasing rate. The state’s population is projected to grow by 1.15 million people (to 24.4 million) over the next five years. Although, the number of people moving to Florida each day is projected to decrease. This reflects a shift in the balance between people moving into Florida due to an abundance of natural amenities, low cost of living, and no personal income tax, and people moving out of Florida, to states like Georgia, Texas and North Carolina.

Employment: There are currently not enough unemployed Floridians to fill existing job openings. Florida’s unemployment rate is expected to increase over the next five years, which will help employers fill vacant positions. However, the number of employed Floridians is projected to increase from 9.96 million in 2024 to 10.7 million in 2029. Florida’s unemployment rate is projected to increase from 3.1 percent in 2024 to 3.7 percent in 2027, and then decrease to 3.6 percent in 2029.

GDP and Income Growth: Florida’s economy will continue to grow through 2029, but at a slower rate. Since inflation erodes the purchasing power of Floridians and limits increases in personal income, the 1.0 percent increase in personal income per capita through 2029 suggests that inflation will be on the decline and the spending capabilities of Floridians will be on the rise.

Tourism: The number of tourists visiting Florida is projected to increase to more than 170 million by 2029. Tourism is projected to increase steadily, from 146.2 million visitors in 2024 to 170.1 million visitors in 2029.Tourism directly supports 13 million jobs and is responsible for $73 billion in employee wages. Due to the revenue tourism generates, every Florida household saves $1,840 a year in state and local taxes.

Overall, Florida’s economy is now set to return to pre-pandemic growth rates over the next five years, due to high economic growth over the past three years.

To learn more and access the full commentary, including Florida TaxWatch’s Florida Economic Forecast 2023-28, Q1 2024, visit https://floridataxwatch.org/Research/Full-Library/florida-economic-forecast.

About Florida TaxWatch

As an independent, nonpartisan, nonprofit government watchdog and taxpayer research institute, and the trusted “eyes and ears” of Florida taxpayers for more than 45 years, Florida TaxWatch (FTW) works to improve the productivity and accountability of Florida government. Its research recommends productivity enhancements and explains the statewide impact of fiscal and economic policies and practices on taxpayers and businesses. FTW is supported by its membership via voluntary, tax-deductible donations and private grants. Donations provide a solid, lasting foundation that has enabled FTW to bring about a more effective, responsive government that is more accountable to, and productive for, the taxpayers it has served since 1979. For more information, please visit www.floridataxwatch.org.